Badass vs Dumbass

Master your Financial Kung Fu to be one and not the other.

"Simply diversify with index funds, and let others take the half-baked wild risks."

- Sifu

Sifu: #1, let’s get down to bizniz. We only started to discuss FIRE the other day. There’s much more to know about FIRE.

Ronin: Oh yeah, early retirement – I am 100% ON FIRE. Get it, bossman?

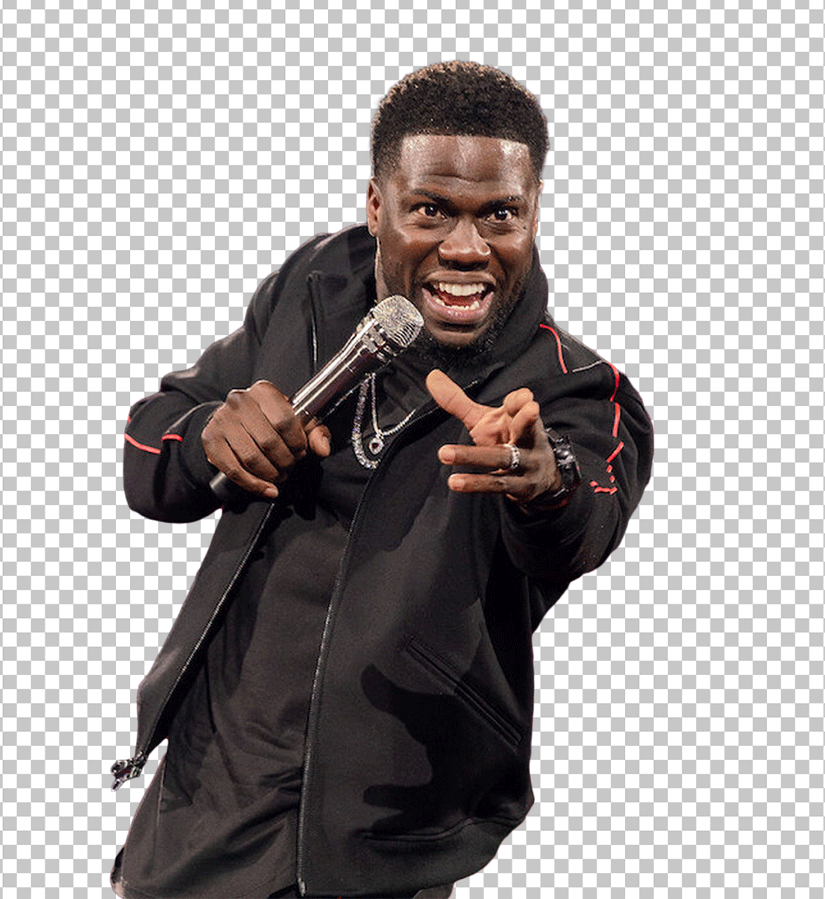

Sifu: Listen Kevin Hart Jr., I suggest you stick to your day job, just in case your dream of being a standup comic doesn’t pan out.

Ronin: Hey hey Sifu. Don’t hate on the jokes. I’m just warming up here!

Sifu: My greatest fear …

Ronin: Remind me again about FIRE … this is my dream of quitting my job in my 30’s so I can start worrying about running out of money in my 40’s, yes?

Sifu: Well perhaps. Only the truly disciplined can harness the power of FIRE. It’s not for the faint of heart or those lacking willpower. Are you weak, bro? You did say you didn’t want to be shackled to your desk for 40 years, didn’t you Ronin?

Ronin: Roger that, Cap. Especially when work will probably feel like “12 Years a Slave” after a while. I def want the shackles off me way before I turn fully gray!

Sifu: Very good, #1. Let’s guide you through this today. There are 12 key strategies to get to FIRE. Ready to get busy?

Ronin: As Freddy – Let’s Go!

Sifu: The first step is to know where every penny is going. Think of it as the financial version of dodging punches—if you can’t see it coming, it’s going to hurt, big time.

Everybody has a plan until they get punched in the mouth.

Mike Tyson

Ronin: I’ve been stretching more in my exercise routine – exactly to dodge your fierce attacks when we spar, Sifu! Let’s see if I can employ the same with my budget and learn to sidestep financial brain farts.

Sifu: Excellent, Young Padawan. The fewer smells the better, I always say! To assist your budgeting, use apps like Mint or YNAB. If you can dodge a roundhouse to your head, dodging an overdraft fee should be dead easy.

Sifu: The more cash you can bring home, the faster you can reach FIRE. It’s like leveling up in a video game—you can’t just Netflix your way to beast mode. Do the work, and pump those hustle muscles!

Ronin: Hmmm right. Ask for a raise, start a side gig, or break out my prize hockey card collection to auction off on eBay?

Sifu: Yes, all good. But you can do more. Try to invest in yourself. Learn new skills, get certifications, become the boss… of your boss.

Ronin: Ha. Just don’t say that too loud – you never know who’s listening. You’ve heard about covert listening devices – they’re real man! Big brother may be listening to us right now!

Sifu: Puleeeeze #1, I told you to stop believing those conspiracy theories from the internet. All bullshit misinformation and fake news. They just want your damned clicks to make ‘em rich. Keep falling for it, and one day they might even take you away in a straight jacket, bro. That shit is dark! Ease up and come back into the light.

Ronin: Ok ok, heard. Back to real news only.

Sifu: To reach FIRE, you must cut away the excess, just as I see you trying to trim the extra fat off your gut to return to six-pack-city. I’m sure those numerous crunches and 10 minute planks are working for you by now.

Ronin: Oh yes, Sifu. Six pack is back! Cutting out the daily lunchtime burgers and poutine is probably helping. Trimming the gut was hard work. I hope trimming from my budget doesn’t feel like misery on steroids!

Sifu: C’mon, Ronin. Cutting back on streaming services, eating out, and buying brand name everything – they should be dead easy for you. Like counting to 1.

Ronin: Ha! Easier said than done, boss. The struggle is real! Ok ok, I will double my efforts on the cutting back. I am also getting tired of funding Jeff Bezos’ space adventures. He’s going to have to do it without me! Damn you, Amazon Prime!

Sifu: I can just imagine Jeff crying in his sleep over the loss, but hey, such is life! Next is automation – it’s key. Let your savings and investments grow while you focus on more important things.

Ronin: Yup, set it and forget it, easy like cooking with my air fryer!

Sifu: Too easy, #1. Automate your savings, your investments, even your bills, and you can just rest easy! And, let the magic of compound interest do the work while you. More time for naps!

Ronin: Yeah bro, like after lunch, I can def do with one! Speaking of which … I’m hungry like a wolf!

Sifu: Where the hell does all that food go – maybe get that checked out, Simon Le Bon. Now, let’s quickly go over investing. It’s crucial to do it wisely. Low-cost index funds are like the slow and steady tortoise in the race to FIRE.

Ronin: So, you’re saying I shouldn’t put a chunk down on that crazy meme stock I heard about in Reddit?

Sifu: Ha, fuck no! Big red flag to do that – pure gambling if you ask me. Simply diversify with index funds, and let others take the half-baked wild risks. You’ll win the race while they’re chasing geese.

Ronin: Got it, boss. No gambling, unless I’m in Vegas … yeah baby!

Sifu: Whuuuut? You’re not …

Ronin: I got you, bossman! Just messin’ around. I quit that high stakes no win scenario waste of time and money aka The Vegas Strip. IF I go there now, it’s strictly for the $10 all-you-can-eat buffet! Now, that’s what I call eating on a budget!

Sifu: Absolutely genius. But please, def see your doc, son. Those meatballs are going straight to your head!

Sifu: High-interest debt is your greatest foe, Ronin. Defeat it with haste, like a ninja in the night.

Ronin: Yeah, I read the fine print. Those audacious rich banking basturds – they’re charging over 20% on overdue bills. I’m paying mine off as quick as The Flash. Enough is enough!

Sifu: Precisely. Attack with the debt avalanche or snowball method, and leave no debt standing. Permission granted to KILL, KILL, KILL it all 😉

Ronin: Woah, feeling your anger dude! Me thinks the banks have robbed Sifu in the past, yes? Dang! That’s like Robin Hood, in reverse …

Sifu: Indeed, Sherlock. They have, as they’ve probably taken too much from just about everyone. If they’re ripping you off, I say banks can stick it where the sun don’t shine. Hee-hee.

Sifu: Tax-advantaged accounts are like a secret weapon in your Bat Utility Belt. Use them to shield your wealth from the taxman’s grasp.

Ronin: Cool, Batman! Max out the 401(k), the IRA, and the HSA? Right after I murder them damned credit card bills!

Sifu: Yes, kill them good, then stick it to the IRS as well. I hope they’re not listening right now …

Ronin: Oh shit, they car hear us? We in deep do-do now, Dark Knight! …. Wait a minute. Ah man … you tricked me, boss! NO ONE IS LISTENING … you’re a very very bad man!

Sifu: You’re a fast learner, #1. Do try to keep up …

Sifu: Now, frugality is a mindset, not a punishment. It’s about valuing what truly matters.

Ronin: You know, boss, I don’t really mind being frugal. I’m getting used to it actually. What I’m struggling with is trying not to look like a cheap-ass with my friends.

Sifu: Ah. This is a tricky one. There are several ways to approach. One is to be totally upfront with those closest to you. If they understand why you’re saving more than spending, they might even join you on your journey! Also, being frugal isn’t being a cheapo, so go ahead and be generous when the occasion arises. Always pay your fair share and even offer to pay once in a while. As long as you’re thoughtful, you’re golden bro. Fuggetaboutit.

Sifu: Geo-arbitrage is the art of moving to a place where your money goes further. Like anywhere far away from here. LOL.

Ronin: Cool! Like moving to Thailand and living on the beach for pennies on the dollar compared to a New York studio apartment?

Sifu: Exactly. Whether domestically or abroad, find a place where your dollars stretch, and your FIRE burns brighter. Amazing to go overseas if you’re working online and not tied to an office. Once you’re FIRE, you can def go international, if that appeals to you.

Ronin: Oh you know it, boss! The beach of my dreams is my current background wallpaper on my laptop. This is why I refuse to lose focus on FIRE.

Sifu: I feel the passion, bro! Def stick with it. Now, we gotta talk about the boogeyman – healthcare. Healthcare costs can be an evil hidden enemy. Plan for it wisely.

Ronin: Everyday, trying my best to stay healthy, boss! Learned from you – treating this bod like a temple! But, I guess, I shouldn’t rely on just hoping I never get sick…

Sifu: Truth, #1. Have insurance, contribute to an HSA, and take care of your health now to avoid expensive treatments later. Just keep planking like a madman – I’m sure you will be the last of us to get sick!

Sifu: Now, an emergency fund is essential. It’s your financial parachute when life decides to push you out of a plane.

Ronin: For times like when my rusty whip breaks down, again…

Sifu: Precisely. Keep it in a high-yield account, and never touch it… unless, of course, you’re about to hit the ground.

Sifu: The path to FIRE is like running a marathon and requires discipline. Impatience is your greatest enemy.

Ronin: That and those damned high interest rate credit cards! FML. I will endure Captain. They can hit me, but I will keep getting back up.

It ain’t about how hard you hit. It’s about how hard you can get hit and keep moving forward.

Rocky Balboa

Sifu: Yes you will, #1. Your laser focus remains undiminished. I approve. To keep you going, remember to celebrate the small victories along the way.

Ronin: Yee-haw, let’s do it! Here goes me not being a cheap-ass: “Just got paid today. Lunch is on me, bro!”

Sifu: Nice, very nice.

Achieving Financial Independence and Retiring Early (FIRE) is a dream for many who wish to break free from the traditional work grind and live life on their own terms. However, reaching this goal requires more than just saving a little here and there; it demands a comprehensive strategy and unwavering commitment. Here are 12 essential strategies to help you achieve FIRE.

1. Track Your Spending and Create a Budget

The first step to financial independence is understanding where your money goes. Without a clear picture of your spending habits, it’s impossible to make informed decisions about where to cut back or how much to save.

How to Get Started:

2. Maximize Your Income

Increasing your income is crucial for accelerating your path to FIRE. The more you earn, the more you can save and invest.

Ways to Maximize Income:

3. Cut Expenses Ruthlessly

Cutting unnecessary expenses is a powerful way to free up more money for savings and investments. However, this doesn’t mean living in deprivation—it’s about spending mindfully.

Tips for Cutting Expenses:

4. Automate Your Savings and Investments

Automating your savings and investments takes the guesswork out of the equation and ensures you’re consistently working towards your FIRE goals.

Steps to Automate:

5. Invest in Low-Cost Index Funds

Investing in low-cost index funds is a popular strategy among FIRE enthusiasts due to their simplicity and long-term growth potential.

Why Index Funds?

6. Pay Off High-Interest Debt

High-interest debt, like credit card debt, can derail your FIRE plans if not addressed quickly. Paying off this debt should be a top priority.

Strategies for Paying Off Debt:

7. Take Advantage of Tax-Advantaged Accounts

Maximizing contributions to tax-advantaged accounts can significantly boost your savings by reducing your taxable income.

Types of Accounts:

*** Canadians: Use RRSP, TFSA, RESP, RDSP, FHSA ***

8. Embrace Frugality in Everyday Life

Frugality is more than just cutting costs; it’s a mindset that prioritizes value over excess. Embracing frugality means making deliberate choices about how you spend your money.

Frugal Living Tips:

9. Consider Geo-Arbitrage

Geo-arbitrage involves moving to a location with a lower cost of living to stretch your savings further. This strategy can be a game-changer for those pursuing FIRE.

Geo-Arbitrage Options:

10. Plan for Healthcare Costs

Healthcare is one of the most significant expenses in retirement, so it’s essential to plan for these costs as part of your FIRE strategy.

Healthcare Planning Tips:

11. Build an Emergency Fund

An emergency fund is your financial safety net. It helps you avoid going into debt when unexpected expenses arise, such as medical emergencies or job loss.

How to Build an Emergency Fund:

12. Stay Disciplined and Patient

The journey to FIRE is a marathon, not a sprint. Staying disciplined and patient is key to reaching your goals.

Maintaining Discipline: