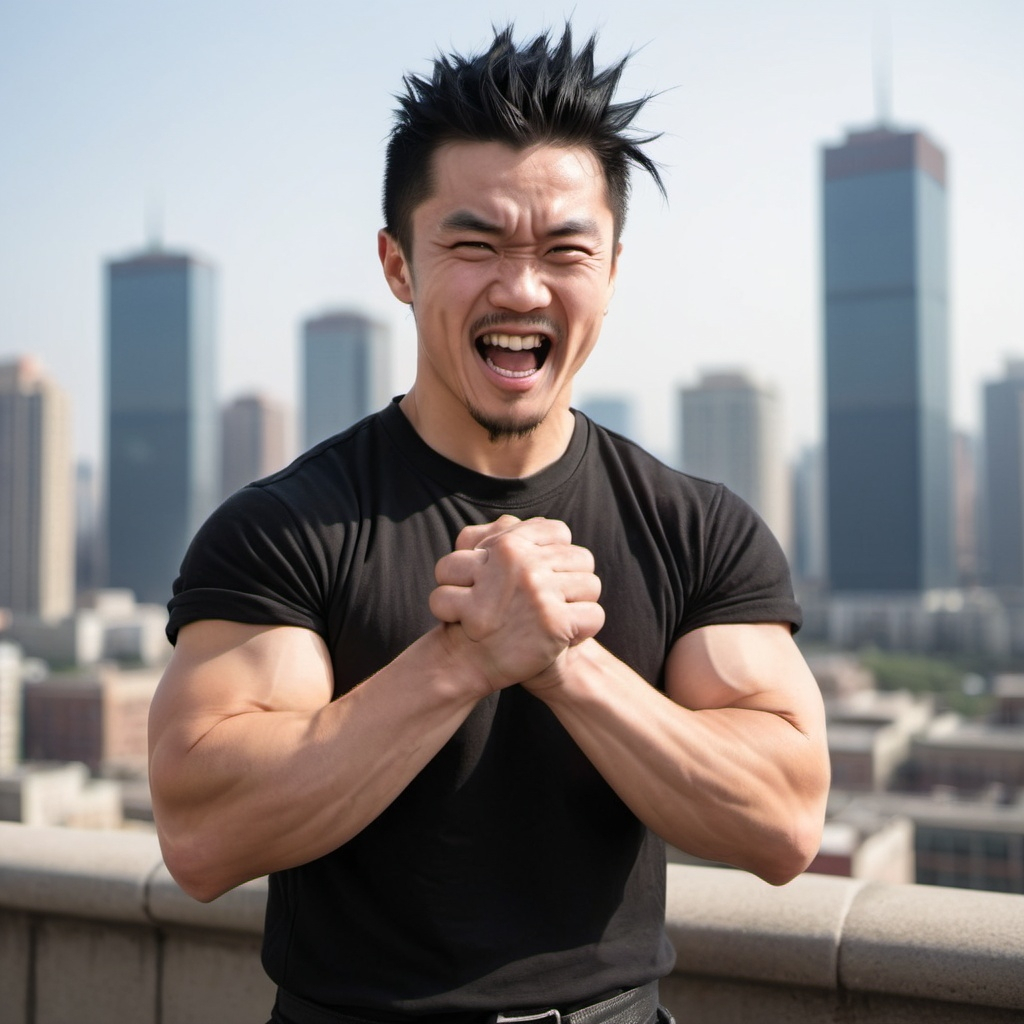

Badass vs Dumbass

Master your Financial Kung Fu to be one and not the other.

"Five bucks a day doesn’t sound like a lot, but do the math – in a year, that little habit will eat almost $2,000 from your savings. "

- Sifu

Sifu: Ronin! Where are you hiding, #1?

Ronin: Right here resting behind the apple tree, Sifu! I thought your 6th sense could detect me anywhere.

Sifu: My Kung Fu is strong, but not that strong … yet! However, your odor should have been a dead giveaway.

Ronin: What? You don’t approve of my new cologne – just got it from the dollar store. You know – living within my means and all. Just like you taught me, boss!

Sifu: Outstanding foolery, Skunk Soul Brother. You’d better go over your notes again. Never have I given you instruction to smell like ass, dumbass.

Ronin: But…

Sifu: No ifs ands or buts here. Except for that nasty BUTT smell from you dude. OK, I get that you’re trying to save cash and not buy Bleu de Chanel, but you’ve gone too far. Next time, if you can’t afford it, just save up some more until you CAN afford it. Patience is required. Or find a less expensive brand that will attract your honeys, and not flies.

Ronin: Ok, gotcha. Def my bad!

Sifu: Going to hold my nose for this lesson now, if you don’t mind. You killing me, bro. Today, we’re discussing the art of budgeting. A crucial skill to keep you on course to financial freedom. You have one yet?

Ronin: Oops, not yet. No wonder my finances are still in a mess. I have a feeling making one will be my homework tonight, right bossman?

Sifu: Amazing foresight, Ronin – good on you. Now, a budget, like a well-executed martial arts form, is about control and intention. It provides clarity and purpose. Let us begin with understanding our financial goals. Why do you think this is important?

Ronin: Dunno, boss. So we have a reason to suffer through all the saving and not splurging?

Sifu: Goals are the foundation. They give meaning to our financial discipline. Whether you seek to escape debt, save for a trip, or plan for early retirement, clear goals keep you on your path. This gives your plan meaningful purpose.

Ronin: So, kind of like having a black belt as a goal in martial arts? It’s not just about the belt, but what it represents. Unlike my leather belt, which is really good for holding up by brand new Big Pants – yeah baby!

Sifu: Precisely. At least those pantaloons of yours don’t smell. WIN-WIN! Now, let’s discuss tracking income and expenses. Understanding where your money comes from and how it’s spent is like knowing your own strengths and weaknesses in battle. You keeping track of your spending?

Ronin: Yeah, it’s easy. I just check my account and pray I haven’t hit zero. Is that a Sifu-approved method?

Sifu: Whoa! Not really dude. Save your praying for the temple, not going to work here. Got to do more. Document all income, from your primary job to any side gigs. Then, track every expenditure. This will reveal your financial habits. It will be eye-opening, like seeing a mirror of your financial soul – IF you have one!

Ronin: I might be staring into the abyss! Do I really need those dirty details on how much I eat out?

Sifu: Yes sir. Don’t be afraid, big boy. You’ll get over the shock – trust me. Categorize your expenses into fixed—such as rent and utilities—and variable—like entertainment and groceries. From there you can set up your budget categories.

Ronin: Alrighty, I’ll do it. It’s not like tracking my expenses can be worse than cleaning toilets.

Sifu: Ha! Sounds easy in comparison. Now, with this clarity, prioritize your essential expenses. In budgeting, as in life, not all needs are equal. Fixed expenses, the necessities, must be addressed first.

Ronin: So, pay my rent before shopping for clothes? Got it. But where does coffee fit in? Please say my bean juice is essential!

Sifu: For some like me, coffee is a necessity. A caffeine-free Sifu, is one pissed off Sifu – let’s not go there. However, because I minimize the cost of my coffee addiction by making my espresso at home, it’s not a biggie. If you go out for coffee daily, that would be a budget-breaker for you. Five bucks a day doesn’t sound like a lot, but do the math – in a year, that little habit will eat almost $2,000 from your savings. You want that Rolex – drink homebrew and you’ll save enough for one in a couple years! Got your attention yet, #1?

Beware of little expenses; a small leak will sink a great ship.

Benjamin Franklin

Ronin: Holy Rollie, Batman! My ears are burning up bro!

Sifu: Thought so. Now, setting spending limits is crucial. Differentiate between needs and wants. Housing, utilities, and food are needs. Starbucks coffee is a want, definitely non-essential. Once you’ve set aside for your needs, here comes the fun part – you can then assign funds to your wants—but responsibly please. This way, you can enjoy life’s pleasures without killing your financial health.

Ronin: But what if I find out I’m spending way more than I earn?

Sifu: Ginormous red flag, #1. This is ass-backwards. You first job is to ensure your income exceeds your expenses, so slow your roll and cut out those non-essentials pronto! This is Job 1, pal. AND, if turns out that your income doesn’t even support your essential needs, you might have to move to a cheaper place. Not paying rent quickly leads to homelessness. You wanna go there, Ronin?

Ronin: NOPE – I like a roof over me, thank you kindly! What about saving and paying off debt? Where do they fit in this magical budget?

Sifu: These are non-negotiable. Allocate a portion of your income towards savings and debt repayment. Aim for at least 20%—split between building an emergency fund, retirement savings, and clearing debt. Any high interest debt should be addressed with urgency.

Ronin: Like facing your toughest opponent first? Makes sense. And savings are like building up your stamina.

Sifu: Good analogies, Rocky.

Ronin: Ok, ok. What happens if a surprise bill is dropped on me? Do I wave the white flag and yell out: “A-D-R-I-A-N!!!”

Sifu: Never surrender, champ! Life is unpredictable, but you and your budget can be adaptable. Regularly review and adjust it. A budget is not one and done. It’s a living, breathing tool. Your flexibility will allow you to deal with unforeseen expenses and your financial plan will remain intact.

Ronin: Gotcha boss. But what about temptations? Cool new tech shit comes out all the time. Those corporations know exactly how to get the attention of geeks like me – BASTURDS!

Sifu: Easy there, cowboy. Knowing this, you steel yourself and be stronger than their temptations. Discipline is key. But also, allow yourself some leeway. Set a small amount aside for discretionary spending. Go ahead and indulge occasionally guilt free without breaking the bank.

Ronin: Oh man. I am definitely looking forward to that “discretionary spending”. Second pair of BIG PANTS, here I come! Any tricks to make this budgeting thing less boring?

Sifu: Yes, #1 – thanks to technology. Automation is your ally here. Set up automatic transfers for savings and bill payments. This minimizes the effort and reduces the risk of forgetting payments or spending the money elsewhere.

Ronin: And budgeting apps? Are they any good and do they cost me money?

Sifu: Many budgeting apps are quite useful, often free or low-cost. Go for free first. They’ll help you track spending, set financial goals, and provide insights into your good or bad habits. It’ll be less tedious and you’ll be more engaged. They may also help you review your numbers and allow for easier adjustments as you go.

Ronin: So, track it all, prioritize needs, control wants, save, pay off debt, and automate! The plan is done and DONE.

1. Understand Your Financial Goals

Before you start budgeting, it’s essential to define your financial goals. Are you saving for a vacation, paying off debt, building an emergency fund, or planning for retirement? Clear goals provide a purpose for your budget, helping you prioritize your spending and stay motivated. Write down your short-term and long-term goals and refer to them regularly to keep your budgeting on track.

2. Track Your Income and Expenses

The foundation of a successful budget is a clear understanding of your income and expenses. List all sources of income, including your salary, freelance work, and any other earnings. Next, track all your expenses for a month, categorizing them into fixed (rent, utilities, loans) and variable (groceries, dining out, entertainment) expenses. This exercise helps you see where your money goes and identifies areas where you can cut back.

3. Prioritize Essential Expenses

Once you have a clear picture of your finances, prioritize your essential expenses. These include necessities like housing, utilities, food, transportation, and healthcare. Ensure these critical needs are covered first before allocating money to other categories. This prioritization helps you maintain a basic standard of living while working towards your financial goals.

4. Set Spending Limits

After covering your essential expenses, set spending limits for discretionary categories like entertainment, dining out, and shopping. Be realistic about your limits to avoid feeling deprived, but also challenge yourself to reduce spending where possible. For example, if you often dine out, consider cooking more meals at home to save money. Setting these limits helps you control impulse spending and ensures you have funds left for savings and debt repayment.

5. Incorporate Savings and Debt Repayment

A practical budget should include a plan for savings and debt repayment. Aim to save at least 20% of your income, directing it towards an emergency fund, retirement accounts, or specific savings goals. If you’re paying off debt, prioritize high-interest debt to save money on interest over time. Consider using the debt avalanche (paying off high-interest debts first) or debt snowball (starting with the smallest debts) methods, depending on your preference for tackling debt.

6. Use a Budgeting Method That Fits Your Lifestyle

Choose a budgeting method that aligns with your spending habits and preferences. Some popular methods include:

Experiment with different methods to find the one that works best for you and keeps you on track.

7. Use Apps and Regularly Review and Adjust Your Budget

Get a free app to help you track spending, set financial goals, and provide insights into your good or bad habits. Life changes, and so should your budget. Regularly review your budget to reflect changes in income, expenses, or financial goals. If you receive a raise, consider increasing your savings rate. If you face unexpected expenses, adjust your discretionary spending to accommodate them. Reviewing your budget helps you stay flexible and ensures it continues to work for your current situation.