Badass vs Dumbass

Master your Financial Kung Fu to be one and not the other.

"Should I even trust advice that’s free? Nothing’s free in life, man!"

- Ronin

Photo by Thierry K on Unsplash

Ronin: Sifu! I’ve gone over your pros and cons of investing through my phone. I’m leaning towards doing it.

Sifu: You sure, #1? I pointed out the cons of these apps so you know exactly what you’re getting into. I don’t want you on your phone every minute of the day. Many in your generation are doing it, but it’s a slippery slope. You really don’t want to be addicted to that instant access.

Photo by PiggyBank on Unsplash

Ronin: Heard. Yes, the precautions you gave are def warranted. I want to have it as a backup to simply trading through my laptop. And having information at your fingertips – it’s never a bad idea, right boss?

Sifu: Hmmm. Maybe. OK, if you promise me you won’t get fired from your job from trading all day, then let’s discuss this some more.

Ronin: Promise, Sifu. No way I’m losing my job – that would be a one-way ticket back to living in Cousin Cletus’ spare room. Hee-hee.

Sifu: Fair enough, Padawan. We’ll go over the top 5 apps available today. Let’s see which one suits you best. Just for kicks, let’s count them down, and save the best for last.

Ronin: Oh, you’re a riot, boss. Hee-hee.

#5 – SoFi Invest: For the Ambitious Yet Lazy

Sifu: SoFi Invest is ideal for young investors seeking a balance between DIY investing and financial planning. You get commission-free trades, crypto access, and free financial advice.

Ronin: Free? Really? Should I even trust advice that’s free? Nothing’s free in life, man!

Sifu: Check. Also, the downside is its limited investment options compared to more established platforms.

Ronin: Ha! I like my options, bro. NEXT!

#4 – Fidelity Go: For the Traditionalist Who Also Likes Robots

Sifu: Fidelity Go offers both DIY investing and robo-advisory options. It’s reliable, with no-commission trades and a variety of account types, including retirement options.

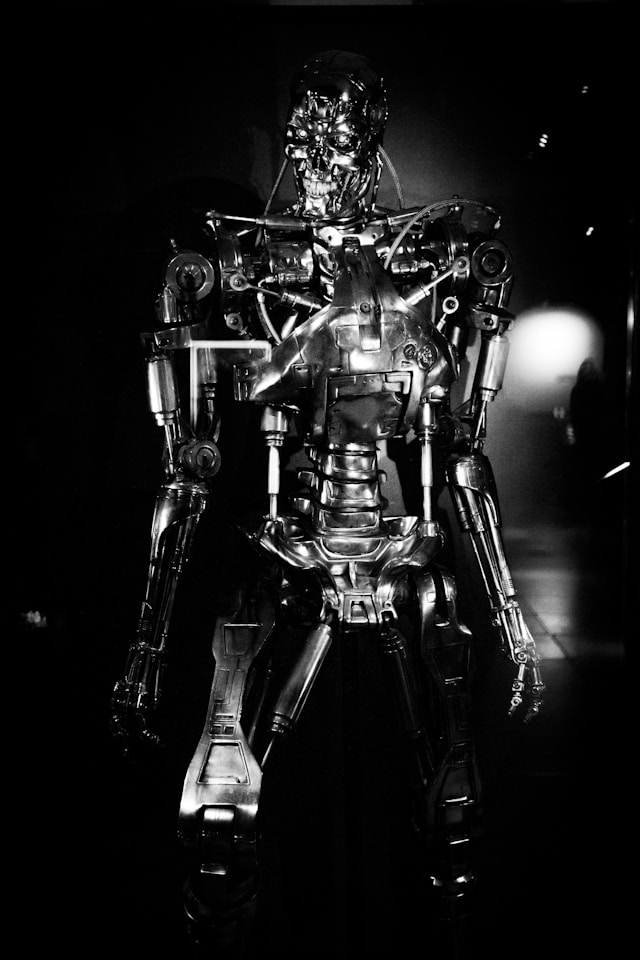

Ronin: Robo-advisor? You’re telling me I can have Skynet manage my money? Sounds like the beginning of end of the world! What can go wrong, eh?

Sifu: Hope not! You should know – the app can feel overwhelming for beginners.

Ronin: No, no, no! I’m a beginner with these apps. NEXT!

#3 – Acorns: For the Investor Who Can’t Put Down Their Latte

Sifu: Acorns is perfect for hands-off investors. It rounds up your everyday purchases and invests the spare change.

Ronin: No way, Jose! I can invest just by buying coffee? Finally, a financial strategy that understands my addiction to my morning jolt!

Sifu: Just be cautious of the monthly fees, which can eat into smaller portfolios.

Ronin: But, I’ll be starting small. Man! NEXT!

Photo by Shot by Cerqueira on Unsplash

#2 – Webull: For the Stock Market Warrior

Sifu: Webull is for young investors seeking more advanced tools. It offers commission-free trades and detailed charts, research tools, and analysis.

Ronin: Advanced tools, eh? Perfect! I love spending hours trying to figure out what all those squiggly lines mean.

Sifu: It’s not ideal for beginners, though.

Ronin: Well, that’s not very nice, is it? NEXT!

#1 – Robinhood: For the Couch Investor

Sifu: Robinhood is the top choice for beginner investors. It’s user-friendly, commission-free, and allows trading in stocks, ETFs, and crypto.

Ronin: Ah, Robinhood! Does it steal from the rich and give to … me? Cuz I’m down with that!

Sifu: Not quite. You should know that it lacks retirement accounts and investment education.

Ronin: Well, I get my education from you, boss, so I think I’m covered there. Overall, I think the pros outweigh the cons, and it does seem like a good fit for me.

Sifu: I think you’ve picked your poison. Be careful, Padawan. Lest you end up a Gordon Gecko daytrader and homeless before you’re 30.

Ronin: Sheeeeeeit.

Here are the top 5 online investing apps for young people (and everyone else), ranked from 5th best to 1st, based on ease of use, features, and popularity:

5. SoFi Invest

Best For: Young investors seeking a mix of DIY investing and financial planning.

Why It’s Great: SoFi offers commission-free trades for stocks and ETFs, access to cryptocurrencies, and automated investing. It also has additional perks, such as free financial planning advice, and includes other financial services like loans and banking.

Downside: Limited investment choices compared to more established platforms like Fidelity.

4. Fidelity Investments (Fidelity Go)

Best For: Young investors looking for a reliable platform with a mix of DIY investing and robo-advisory options.

Why It’s Great: Fidelity offers no-commission stock and ETF trades, a variety of account types (including retirement accounts), and Fidelity Go, which is a robo-advisor for automatic investing. They also provide a wealth of educational resources for beginners.

Downside: Not as sleek or simple as apps like Robinhood; the app can feel overwhelming for absolute beginners.

3. Acorns

Best For: Hands-off investors looking for automated investing with a focus on micro-investing.

Why It’s Great: Acorns rounds up everyday purchases and invests the spare change into diversified portfolios. It’s perfect for those who want to start small and invest passively without needing to pick individual stocks.

Downside: Monthly fees can add up for smaller portfolios, especially for beginners.

2. Webull

Best For: Young investors seeking more advanced tools and a commission-free platform.

Why It’s Great: Like Robinhood, Webull offers commission-free stock and ETF trading but provides more in-depth charts, research tools, and analytical features. It’s great for those who want to move beyond the basics.

Downside: Not ideal for absolute beginners due to more complex features.

1. Robinhood

Best For: Beginner investors and those looking to trade stocks, ETFs, and crypto with zero commissions.

Why It’s Great: Robinhood is incredibly user-friendly, making it easy for beginners to get started in investing. It offers commission-free trades, no minimum account balance, and access to cryptocurrencies alongside traditional stocks and ETFs.

Downside: Limited investment education and no retirement accounts (IRAs).

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any significant financial decisions.