Badass vs Dumbass

Master your Financial Kung Fu to be one and not the other.

"As for climate change, that shit is real. It would not be cool to retire to a world without stunning warm sandy beaches."

- Sifu

Sifu: Snap to it, Ronin! Why are you here if you’re just going to nod off? This is our first day, and you’re already treating it way too casually bro!

Ronin: Yeah yeah, I’m here, I’m here. Late night clubbing with my crew, that’s all. What do you expect – it was a Monday night.

Sifu: Wow. Unbelievable, Little Man.

Ronin: Who you calling “Little”, Sifu? I’ve been lifting beaucoup pounds at the gym. Check out my guns!

Sifu: Put away those weak weapons, fool.

Ronin: Really dude? I can probably take you on, Old Man!

Sifu: In whose universe exactly, idjit? You’re like Neo against Morpheus, when they first meet. I hit you, and you might wake up some time next week.

Ronin: Easy, e-a-s-y boss. You know I’m just messing around with you, right?

Sifu: Ha! Of course, #1. But when you’re really ready, I’ll be waiting.

Ronin: Sheeeeeeit. Ok dude, we cool. We COOL!

Sifu: So, you working on what, 3 or 4 hours of sleep?

Ronin: Just two, but you know what I always say, “I’ll sleep when I’m dead”.

Sifu: Right you are, Rotwalker.

Ronin: Hey Sifu. You finally going to open up your private black book, and share some nefarious ninja secrets that will fund my early retirement. You know that beach living awaits no man! Got to get there before climate change puts all of us under water. Am I right, Boomer?

Sifu: Ronin, you keep your stealthy fingers off my black book. I could tell you one of the secrets in it, but then I’d have to kill you.

Ronin: Doh! You don’t play fair, Mr. Bond.

Sifu: Trust me, the contents are too powerful for you – the information it contains is not for newbie investors. I may decide to share a couple of my most confidential financial secrets with you, but only when you’re ready – NOT today, #1. But I do admire your ballsy request. You must have paid attention when they taught: “You can’t get it if you don’t ask for it”.

Ronin: Fact!

Sifu: As for climate change, that shit is real. It would not be cool to retire to a world without stunning warm sandy beaches. And, I definitely want an invitation to your dream beach house before I go fully gray! Was that in Goa or Kawaii … I keep forgetting.

Ronin: E-nope, actually moved on from those. That beach pad will be now in one of 3 spots: Whitehaven Beach in Australia, Grace Bay in Turks and Caicos, or Maya Bay in Thailand. I’ve done my research.

Sifu: Go big or go home! Nice, #1. Maya Bay from The Beach, correct? Outstanding EDM from that movie soundtrack.

Ronin: Yes, if it’s good enough for DiCaprio, it’s good enough for me. Those beaches are otherworldly. Maybe I get set up in Thailand, and you pick up sweet beach estates in Aussie and T&C. What better way to spend a fraction of your massive FU Money stash; am I right, boss?

Sifu: Ha! I thank you in advance for helping me unload that huge burden, Beach Boy. 😉 BUT, I get to spin my tracks at your beach party, aight?

Ronin: Def! You will have a permanent resident spot at my beach club, Master DJ.

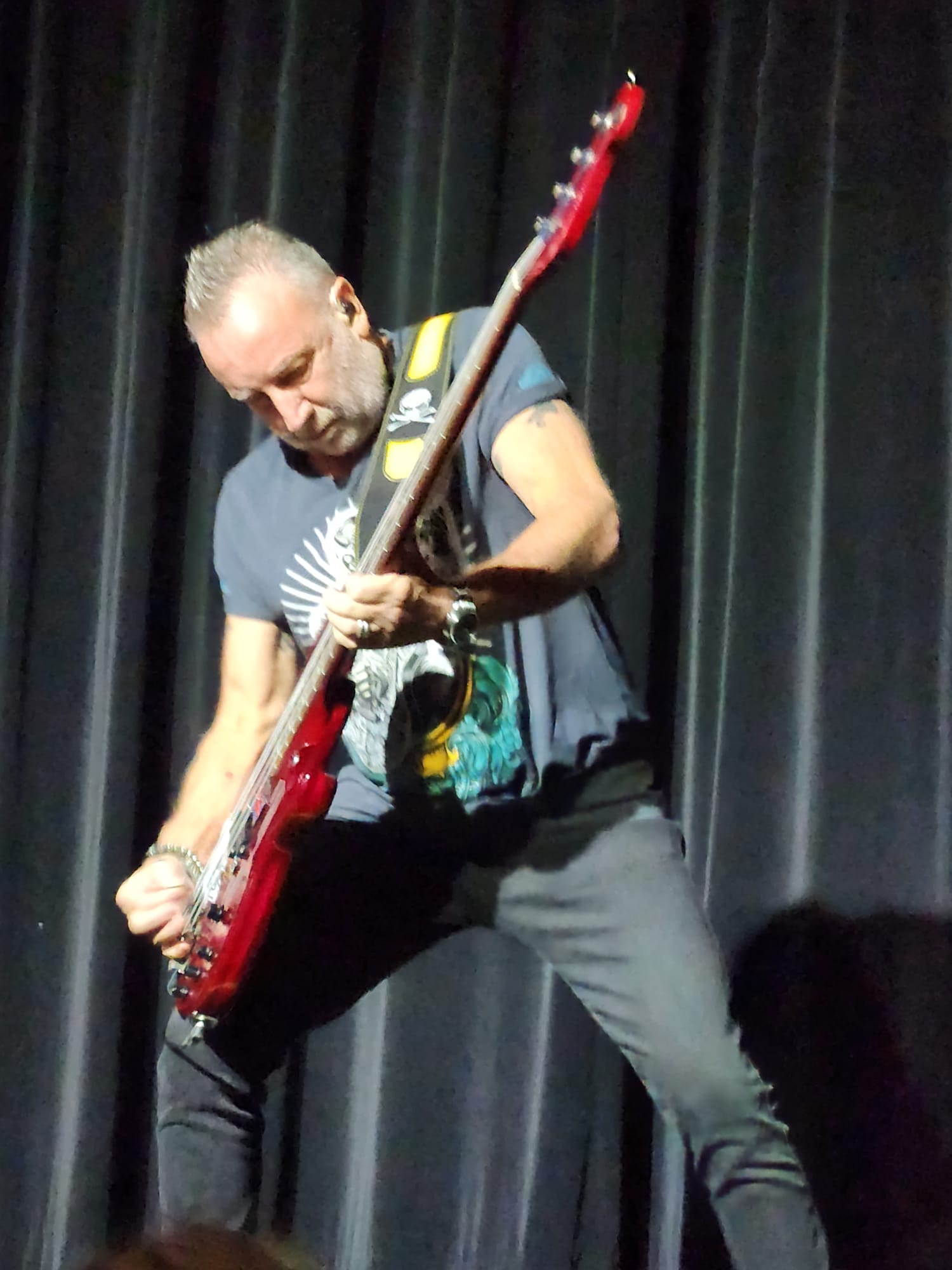

Sifu: Excellent! Ok, let’s get to it, shall we. This is the beginning of our journey together through the fog of personal finance. Today is just a quick overview. Over time, I’ll show you exactly how to master it. Master it like a boss, kind of like this guy …

Ronin: Dude! Hooky is one Badass MoFo! Definitely a Boss. I’m in!

Sifu: Excellent, #1 – I knew he would inspire you. This path will lead you to wealth creation, financial independence, and ultimately, financial freedom. So, you’re ready to embark on this adventure?

Ronin: Adventure, huh? Like a magical journey where I can transform my dollar store watch into a gold Rolex? Or like fighting a fire-breathing dragon in Game of Thrones? Either way, if you throw in extended lunch breaks, I’m in, Sifu!

Sifu: Done and done, son! Actually, the dragon we’re facing is financial ignorance. Why do I think you’re an expert in that area? Never mind. In our adventure, the treasure we seek is better than a gold watch, and that is financial wisdom. I see great potential in you, Ronin. If you stick with me, you too can be wise.

Ronin: Very nice! Better than a Rollie? I’ll still take it, if that’s ok with you. Beggars can’t be choosers, am I right?

Sifu: Uh-huh. The first thing you need to understand is the importance of setting clear financial goals. Without a destination, you’ll just wander aimlessly.

If you don’t control your money, your money will control you.

John C. Maxwell

Ronin: How exactly do you wander without being aimless? Ok ok, goals it is. What’s next?

Sifu: Next, we need to create a budget. A budget is like a map that guides you towards your financial goals. It helps you track your income and expenses, ensuring you live within your means and save for the future.

Ronin: A map, huh? Like Google Maps or Waze? I actually prefer Waze – keeps me safe from the po po – IYKYK! I always thought budgets were more like prison bars, keeping me from spending on YOLO shit. But I’m open to learning more about that. You are the wise one, after all, bossman!

Sifu: Right you are, YOLO-breath. Think of it as a tool for freedom, not restriction. By managing your money wisely, you’ll have more control over your financial future. Now, let’s talk about debt. It’s a double-edged sword. Used wisely, it can help you build wealth. Mismanaged, it can lead to financial ruin.

Ronin: Ah, debt. The dark side of the force. Got it, Lord Vader. So, how do I wield this power without getting burned?

Sifu: Good question, Skywalker. The key is to differentiate between good debt and bad debt. Good debt, like a mortgage or student loan, can help you acquire assets or improve your earning potential. Bad debt, like high-interest credit card debt, can drain your resources and hinder your financial progress.

Ronin: So, avoid bad debt like avoid that girl with a full mustache and extra long nose hair, and use good debt to my advantage. Easy peasy, lemon squeezy! What’s next on the hit list, Sifu?

Sifu: We can discuss excess hair another day, but yes sir. Next, we need to discuss the importance of saving and investing. Saving is the foundation of financial security, while investing is the key to wealth creation. You should aim to save at least 20% of your income and invest it wisely to grow your wealth over time.

Ronin: Saving 20%? Let me check that on my calculator … holy crap, that’s a lot, Kemosabe! How the hell am I suppose to live my gangsta lifestyle, when I have to save this much cheddar?

Sifu: Yo Killa. Sacrifice is needed at times, otherwise your future is DOOMED. You really want to win a gold medal in dumbassery, don’t you?

Ronin:. Oy! Ok ok. I guess if I want to be a Financial Badass, I need to make some sacrifices. And investing… that’s like planting seeds for future money trees, right?

The best time to plant a tree was 20 years ago. The second best time is now.

Chinese Proverb

Sifu: This isn’t some Jack and the Beanstalk fairytale, but close enough! Investing allows your money to work for you, generating returns and building wealth over time. But remember, investing comes with risks. It’s important to diversify your investments and understand the risks involved.

Ronin: Diversify, huh? So, don’t put all my eggs in one basket. Is that like, go out with 5 girls at once, to make sure you get a couple of good ones?

Sifu: Yes … wait NO! Don’t try to trick me with your wicked ways, #1. I got my one good eye on you at all times, wiseass!

Ronin: Kidding, old man! Relax. Your #1 is as decent as you are, Sifu.

Sifu: Oh shit! Sifu is not that decent 😉

Ronin: I knew it!! No worries, I got your back regardless, boss. No one is perfect.

Sifu: Tru dat. Next … we also need to talk about the importance of insurance. Insurance protects you from financial setbacks caused by unexpected events, like illness, accidents, or natural disasters. It’s a crucial part of any financial plan. Perhaps, insurance is a necessary evil.

The purpose of insurance is not to you make you rich but to make you whole again after a loss.

Unknown

Ronin: Evil! Like Voldemort-evil? Or like the kind of evil perpetrated when you have red wine with seafood? But I get it. Better to be safe than sorry. Anything else, Sifu?

Sifu: We need to discuss the importance of continuous learning. The financial world is constantly changing, and staying informed is key to making smart financial decisions. Even Sifu learns new things all the time. Read books and blogs, listen to podcasts, and seek advice from financial experts.

Ronin: Books? Continuous learning? I just got out of school recently. Aren’t I edumacated enough?

Sifu: Not really, Ronin. Your schooling gave you the very basics, but there is much to learn if you want to live a full life. As some say, “the real learning begins when school ends.”

Ronin: Damn. Now I wonder what else they conveniently forgot to teach me in school. I can only hope this continuous learning will be as much fun as the time I’m having with you.

Sifu: Excellent, #1. Keep buttering me up. It might pay off one day.

Ronin: Too much, Sifu?

Sifu: As Vandross says, “It’s Never Too Much”. Lastly, remember, the journey to financial mastery is a marathon, not a sprint. Stay patient, stay disciplined, and you’ll achieve your financial goals.

Ronin: Always so damned wise, both you and Luther. Looking forward to next time, and that Rolex!

Check Out the “Badass Song of the Day” Spotify Playlist – New Songs Added Weekly