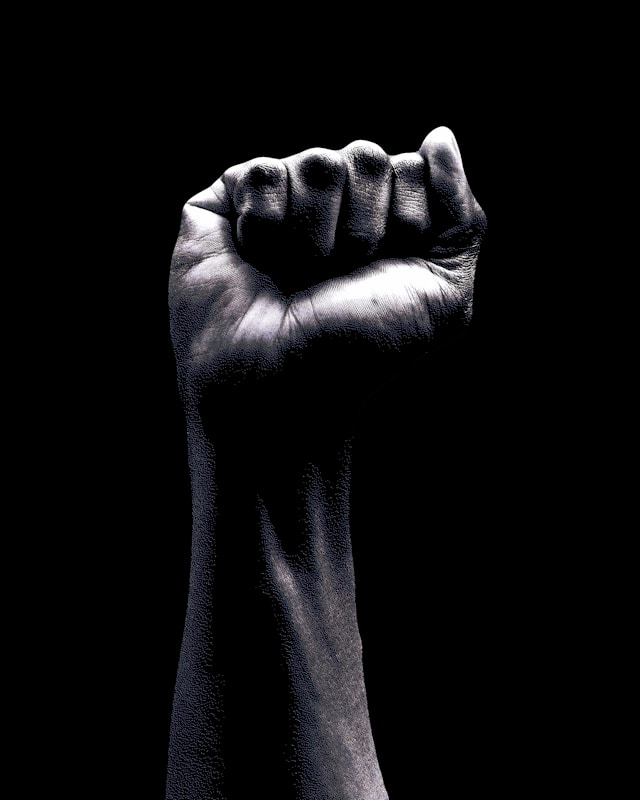

Badass vs Dumbass

Master your Financial Kung Fu to be one and not the other.

"Go Ahead, Be Irresponsible—But Not Too Irresponsible."

- Ronin

Photo by Nathan Dumlao on Unsplash

Ronin: Sifu! I have a serious problem here, boss. I’m trying so hard to stay on my FIRE journey, You know, living below my means and all that biz. But the distractions are killing me. All my friends wanna do is spend all their money on YOLO fun shit.

Sifu: Heard. Who doesn’t love to have fun all the time?

Ronin: Exactly! And here I am living on rice and water, saving every dollar that I can and investing it for my future. I’m missing out on everything! Makes me question my strategy. Maybe … I’m missing out on life. You know what I mean, bro?

Sifu: A life totally devoted to delayed gratification is soul-sucking and deprives you of joy. Meanwhile, a life dedicated to YOLO will kill your future and any chance of FIRE. Both paths can lead to ruin. It seems you are not balanced in your approach to FIRE.

Ronin: I’m all ears, Master. Teach me how to splurge like a rock star while saving like a monk.

Sifu: Ha! First, we set clear financial goals.

1. “Kung Fu Goal Setting: Because Wingin’ It Isn’t a Plan”

Sifu: To achieve balance, one must have a clear vision. Set both short and long-term goals.

Ronin: Like saving up for that new Apple watch versus the “I need to retire someday” fund?

Sifu: Hmmm … yes. Prioritize your goals. For example, an emergency fund might be more urgent than upgrading your wristwatch.

Ronin: Are you sure, Sifu? Have you seen the features on that baby – it’s totally tricked out!

Sifu: That watch cannot buy food in a crisis, Ronin.

Ronin: I know, I know. So, emergency fund first, then I can justify blowing cash on cool shit. Got it.

2. “The Fun Fund: Where Your Wallet and Happiness Meet for Drinks”

Sifu: Next, create a Fun Fund. Allocate a portion of your income solely for joy.

Ronin: Now, you are talkin’ my language, bossman! Fun Land – here we come!

Sifu: I get it #1. I’m young at heart too! The Fun Fund prevents you from feeling deprived. It allows you to enjoy life without jeopardizing your future.

Ronin: So, it’s like giving your inner child a weekly allowance so it doesn’t throw a tantrum in the middle of Best Buy?

Sifu: A wise analogy. By planning for enjoyment, you avoid reckless spending. But, remember to adjust the Fun Fund as needed.

Ronin: Roger that. I’ll make sure my Fun Fund is fat enough to handle emergencies, like when concert tickets go on sale.

Sifu: Word.

3. “The 80/20 Rule: Saving for Tomorrow While Still Affording Avocado Toast”

Sifu: Now, consider the 80/20 rule. Allocate 80% of your income to essentials and savings, and 20% to fun.

Ronin: So, 80% for boring adult stuff, and 20% for pretending I’m still cool?

Sifu: More or less. Adjust the ratio based on your goals. If you need to save aggressively, perhaps 90/10 would suit you better.

Ronin: 90/10? I’d need a medal for Adulting Excellence to pull that off.

Sifu: Even small adjustments can lead to great results over time, Padawan.

Ronin: Fine. I’ll try to be more “80/20” and less “100% YOLO.”

4. “Celebrate Milestones: Because Financial Wins Deserve a Fist Pump”

Sifu: It’s important to celebrate financial milestones, no matter how small.

Ronin: So, every time I skip buying coffee and save $5, I get to treat myself to… coffee?

Sifu: Not quite. When you achieve a goal, reward yourself with something meaningful but proportionate.

Ronin: Like a “You Didn’t Eat Out for a Whole Month” trophy?

Sifu: More like a nice dinner out after reaching a savings target. Small rewards prevent burnout and keep you motivated.

Ronin: Hey, that works! Isakaya sushi is an excellent reward I can work towards!

5. “Experiences Over Stuff: Because Memories Don’t Require Batteries”

Sifu: Focus on spending money on experiences rather than material goods.

Ronin: So, you’re saying a weekend getaway is better than buying sick new kicks?

Sifu: Yes sir. Experiences bring more lasting joy and fulfillment.

6. “Plan for Spontaneity: Because ‘I’ll Just Buy This One Thing’ Never Ends Well”

Sifu: Allow room for spontaneous purchases, but plan for them.

Ronin: Spontaneous, but planned? Oxymoron, dude! That’s like scheduling your surprise parties.

Sifu: Think of it as a controlled indulgence. Set aside a small amount each month for unplanned expenses.

Ronin: So, a “Go Ahead, Be Irresponsible—But Not Too Irresponsible” fund?

Sifu: Exactly. This way, you can indulge without feeling guilt or throwing off your budget.

Ronin: Geinus, boss. Structured recklessness. I’m down!

7. “Comparison is the Thief of Joy”

Sifu: Finally, avoid comparing your journey to others. It leads to unnecessary spending.

Ronin: But, Sifu, if I don’t compare, how will I know I’m better than everyone else?

Sifu: Oy! That’s true dumbass thinking, my man. True satisfaction comes from meeting your own goals, not exceeding someone else’s.

Ronin: So, basically, “stay in my lane and keep my eyes on my own paper”?

Sifu: Ha! Back to school, eh? Yes #1. Social media can mislead. Focus on your path and be grateful for what you have.

Ronin: Got it. I’ll try to be grateful for my 5-year-old phone… right after I stop drooling over the new one.

Sifu: Balancing YOLO and delayed gratification is an art. Enjoy life, but remember, the journey ahead is long.

Ronin: Ok ok. I’ll make sure my financial journey is paved with fewer potholes of impulsive splurging and more pit stops of planned fun. You like my NASCAR reference , boss?

Sifu: Hahaha. Wise words, Ronin.

Ronin: Can we use some of my Fun Fund cash to buy us pizza for lunch now? Balancing hunger and patience is hard work!

Sifu: Deal #1. Pizza it is. Even a master needs a cheat meal. Let’s go!

Photo by Klara Kulikova on Unsplash

Finding the right balance between enjoying life now and planning for the future is essential for financial well-being. The YOLO (You Only Live Once) mindset encourages living in the moment and spending freely, while delayed gratification focuses on saving and investing for long-term goals. Here are some practical strategies to strike a balance between these two approaches:

1. Set Clear Financial Goals

2. Create a “Fun Fund”

3. Adopt the 80/20 Rule for Spending and Saving

4. Celebrate Financial Milestones

5. Choose Experiences Over Material Goods

6. Plan for Spontaneity

7. Avoid Comparisons

8. Regularly Reevaluate Your Balance

Final Thoughts

Balancing YOLO and delayed gratification is about enjoying life today while safeguarding your financial future. By setting goals, budgeting for fun, and making mindful choices, you can live a fulfilling life without sacrificing your long-term security. Remember, life is meant to be enjoyed, but it’s also important to plan for the journey ahead.