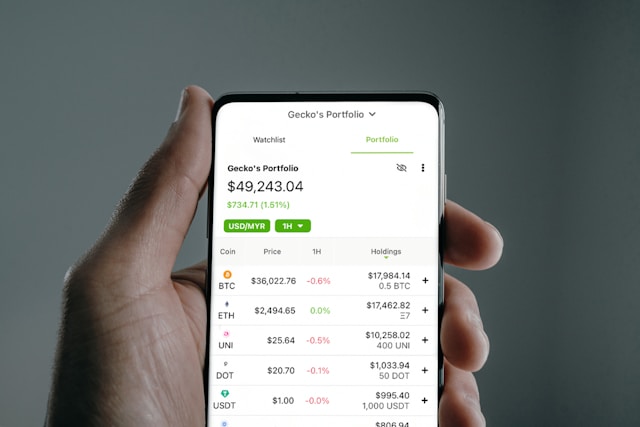

Badass vs Dumbass

Master your Financial Kung Fu to be one and not the other.

"Some people get those apps and find themselves stuck on their phones the whole day, and end up day trading their life away."

- Sifu

Photo by PiggyBank on Unsplash

Ronin: Sifu! I’ve been investing for a while now, and always online through my laptop. Many of my colleagues are doing it right from their phones using these cool apps. They swear by it. Whatdya think? Should I do it too?

Sifu: Ah! Who doesn’t want real-time access to see their investments go up and down during the trading day like a rollercoaster? You sure you’re ready for it, #1? It’s a slippery slope. Some people get those apps and find themselves stuck on their phones the whole day, and end up day trading their life away.

Photo by Priscilla Du Preez 🇨🇦 on Unsplash

Ronin: Ai-ya! That was def not my intention!

Sifu: Investing apps are like a double-edged sword. They can either make you rich or make you rethink all your life decisions while you’re crying over your phone.

Ronin: Oy! Still, I really want to know the pros and cons of doing it. Does it make sense for someone like me?

Sifu: Alright, if you really want to know, we can go over my plus and minus list for using these apps. I’m sure adding one more app to your phone won’t break it, eh?

Ronin: Ha! 99 apps and one more won’t break it. Unless it’s a bitch, feel me boss?

Who dat?

Sifu: Word. Before we go over the dark side, let’s talk about the pros.

1. Low or No Fees: No Fees, No Foul

Sifu: Many apps, like Robinhood and Webull, offer commission-free trading. You can buy and sell stocks, ETFs, and even cryptocurrencies without being eaten alive by fees.

Ronin: Perfection! I lose enough money on my bad decisions—I don’t need fees joining the party too.

2. Accessibility: Investing for the People

Sifu: These apps make investing accessible to everyone, especially young people with little capital. Some have no account minimums, so you can start investing with just a few dollars.

Ronin: Sweet! So I can start my wealth-building journey with the nickels I find between my couch cushions. Yee-haw!

3. Ease of Use: Even a Caveman Could Trade

Sifu: They are very user-friendly, designed for beginners, even dumbasses like you, Ronin. You don’t need to be a financial guru to get started.

Ronin: Easy there, Hos! I’m no wiz but at least I can still feel like I’m playing in the big leagues, eh? Sign me up!

4. Fractional Shares: I’ll Take 0.001% of Netflix, Please

Sifu: Some apps allow you to buy fractional shares. So you don’t need thousands of dollars to invest in big companies like Netflix or Berkshire Hathaway.

Ronin: Yes sir! Finally, I can tell people I own Netflix, not just watch it 24-7. Well, part of it. A very small, microscopic part. But still, it counts, right?

5. Automation Options: Hands-Off Wealth Building

Sifu: Apps like Acorns and SoFi offer automated investing features, so you can invest on autopilot. Just set it and forget it.

Ronin: Invest and get rich while I sleep? That’s my kind of plan! I can dream, right?

6. Educational Tools: School’s in Session

Sifu: Some apps, like Fidelity, offer educational resources to help you learn about investing and make informed decisions.

Ronin: Always “Back to School” for Ronin. Yeah yeah…

7. Real-Time Market Access: Get in the Game Anytime, Anywhere

Sifu: You can monitor the markets and make trades in real-time, all from your phone.

Ronin: So, I can lose money during dinner, on the bus, or even in the bathroom? The future is truly here!

8. Diversified Investments: Variety Is the Spice of Life

Sifu: Many apps offer access to a range of investments—stocks, ETFs, bonds, and even cryptocurrencies. It’s easy to diversify your portfolio.

Ronin: Noice! I’ve always wanted to spread my dollar bills across multiple assets, and feel like a boss!

Sifu: But every rose has its thorns, #1. Here are the cons.

1. Limited Financial Guidance: You’re Flying Solo

Sifu: Many of these apps offer little to no personalized financial advice. You’re left to figure out long-term strategies on your own.

Ronin: Kind of like being given the keys to a Bimmer but no map? I’ll probably drive it straight into a ditch.

Sifu: Better not be my car!

2. Over-Simplification: Investing Isn’t a Game

Sifu: Some apps oversimplify the process, making it feel more like a game. This can encourage users to make quick, emotional decisions.

Ronin: Oh, dang! I love games. They’re targeting me, aren’t they?

Photo by Afif Ramdhasuma on Unsplash

3. FOMO and Impulsive Trading: The Emotional Rollercoaster

Sifu: Real-time notifications can lead to impulsive trades driven by fear of missing out, hurting long-term returns.

Ronin: Excellent. Now I can lose sleep and money in equal measure. Nothing like a little anxiety with my morning joe.

4. Lack of Advanced Features: Basic Is as Basic Does

Sifu: Some apps lack advanced features, like mutual funds or retirement accounts, limiting your growth potential.

Ronin: So, it’s like giving me a Swiss Army knife, but only the toothpick works? Handy.

5. Fees for Premium Services: The Fine Print Bites

Sifu: While basic trading may be free, apps like Acorns charge fees for automated services, which can add up over time.

Ronin: So much for “free”!

6. Market Risk: The Rollercoaster You Didn’t Ask For

Sifu: Just because investing is easy doesn’t mean the market is safe. Young investors may underestimate the risks.

Ronin: I know, I know. Investing is not gambling though, right?

Sifu: All depends on you, #1.

Ronin: Doh!

7. Temptation to Overtrade: Easy Come, Easy Go

Sifu: The ease of trading can tempt users to trade too frequently, leading to short-term losses and tax inefficiencies.

Ronin: Why am I thinking those short-term losses can add up to making this venture not worthwhile?

Sifu: Ronin, you must tread carefully. Investing apps offer great power but require wisdom to avoid pitfalls. I suggest you sleep on it. This is not for faint of heart. Using apps for the pros requires discipline. Got any?

Ronin: Hee-hee. Lots of discipline, boss. Don’t you worry. Hey boss, I’ve been humming this tune in my head all day, and want to hear it in all its glory. Let’s head to your man-cave and play it loud on your tricked out audio gear.

Sifu: Only if I don’t have to do any drywall repair afterwards.

Ronin: Ha! Here it is Sifu. Enjoy, my man…

IN THIS WORLD – MONDO GROSSO Featuring Ryuichi Sakamoto (387) MONDO GROSSO / IN THIS WORLD feat.Ryuichi Sakamoto[Vocal:Hikari Mitsushima] – YouTube

Sifu: You do know that Ryuichi Sakamoto is from Yellow Magic Orchestra (YMO), one of my favorite, right? Trying to get on my good side, eh?

Ronin: Hee-hee. Always, Sifu. Always.

1. Low or No Fees: Many online investing apps (like Robinhood and Webull) offer commission-free trading, which means you can buy and sell stocks, ETFs, and even crypto without incurring fees that eat into your returns.

2. Accessibility: These apps make investing more accessible to everyone, including young people with little capital. Many apps have no account minimums, allowing you to start with just a few dollars.

3. Ease of Use: Most apps have simple, user-friendly interfaces that make it easy to trade or invest, even for beginners with no prior experience.

4. Fractional Shares: Many apps let you buy fractional shares of expensive stocks, meaning you can invest in big companies like Amazon or Tesla without needing thousands of dollars upfront.

5. Automation Options: Apps like Acorns and SoFi Invest offer automated investing features, allowing you to invest on autopilot with recurring deposits or spare change.

6. Educational Tools: Apps like Fidelity provide learning resources and tools to help you make informed decisions and build a solid understanding of investing.

7. Real-Time Market Access: You can monitor and make trades in real time from your phone, ensuring you’re never out of touch with your investments.

8. Diversified Investments: Many apps offer access to a wide range of investment options, including stocks, ETFs, bonds, and crypto, letting you diversify your portfolio.

Cons:

1. Limited Financial Guidance: Many beginner-friendly apps provide little to no personalized financial advice. While they make trading easy, they don’t offer much help in terms of building a long-term investment strategy.

2. Over-simplification: While ease of use is a pro, some apps can oversimplify investing, encouraging users to treat it more like a game or quick money-making scheme rather than a thoughtful long-term approach.

3. FOMO and Impulsive Trading: Real-time notifications and ease of use can lead to emotional, impulsive trading or attempts to “time the market,” which can hurt returns over the long term.

4. Lack of Advanced Features: Some apps (like Robinhood) lack advanced features like access to mutual funds, retirement accounts (IRAs), or complex investment strategies, limiting growth opportunities.

5. Fees for Premium Services: While basic trading may be free, apps like Acorns charge monthly fees for their automated services, which can add up, especially if you’re investing small amounts.

6. Market Risk: Just because trading is easy doesn’t mean the market is safe. Young, inexperienced investors may underestimate the risks of trading volatile assets like cryptocurrencies or penny stocks.

7. Temptation to Trade Too Frequently: Because trading is so easy, users might be tempted to overtrade, leading to short-term losses and tax inefficiencies instead of long-term wealth accumulation.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any significant financial decisions.